Introduction to Rivian

Welcome to the electrifying world of Rivian, where innovation meets sustainability in the fast lane. As one of the pioneers in the electric vehicle industry, Rivian has been making waves with its cutting-edge technology and bold vision for a greener future. Buckle up as we deeply dive into Rivian’s stock forecast analysis and explore what lies ahead for this trailblazing company.

Rivian’s Growth and Recent News

Rivian, the electric vehicle company making waves in the industry, is showing significant growth and momentum. In recent news, Rivian announced a successful IPO, raising billions of dollars from eager investors looking to capitalize on the future of sustainable transportation.

With their innovative lineup of electric trucks and SUVs gaining popularity among consumers increasingly conscious of their carbon footprint, Rivian’s market presence continues to expand rapidly. The company’s collaborations with major brands like Amazon for delivery vans further solidify its position as a critical player in the EV space.

Despite facing challenges such as supply chain disruptions and increasing competition from established automakers entering the EV market, Rivian’s strong leadership team and commitment to innovation set it apart. Investors closely watch how Rivian navigates these obstacles while staying true to its mission of revolutionizing transportation with clean energy solutions.

Analysis of Rivian’s Financials and Market Performance

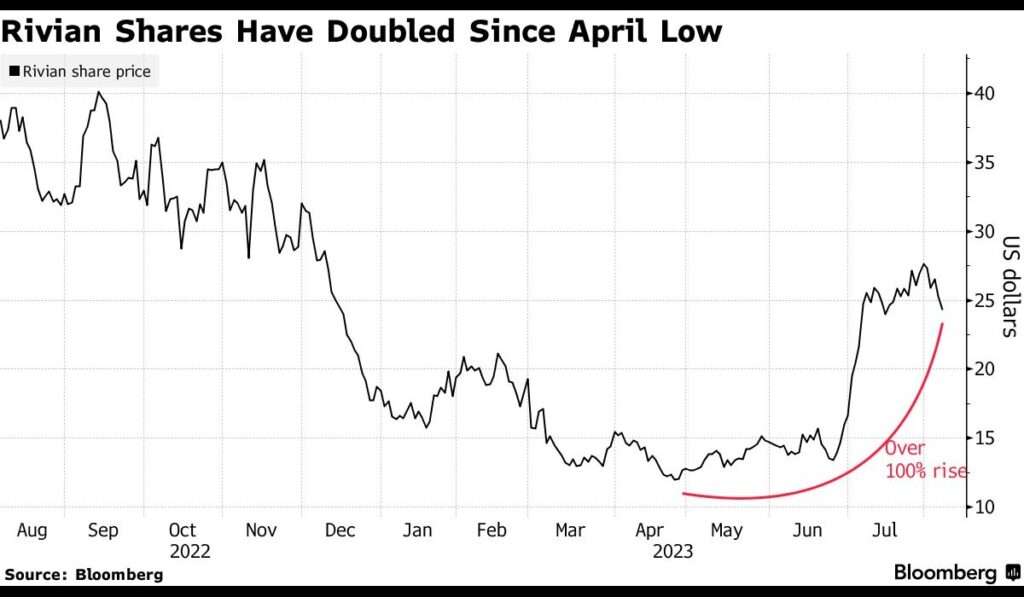

Rivian’s financial performance has been closely scrutinized as the company continues to wave in the electric vehicle industry. With a successful IPO and strong investor interest, Rivian’s market performance is one to watch.

Analysts have been impressed by Rivian’s revenue growth, driven by increasing demand for their electric vehicles. The company’s strategic partnerships and innovative technology position it as a critical EV player.

However, some concerns linger around Rivian’s profitability as they invest heavily in research and development. Market volatility and competition from established automakers complicate Rivian’s future outlook.

Investors closely monitor how Rivian navigates these challenges while maintaining its position as a leader in sustainable transportation solutions. Time will tell how their financials evolve amidst this dynamic landscape.

Competitors in the Electric Vehicle Industry

In the rapidly evolving electric vehicle industry, Rivian faces stiff competition from established players like Tesla, known for its innovative technology and market dominance. With a strong focus on sustainability and cutting-edge design, Tesla continues to set high standards in the EV market.

On the other hand, companies like Ford with their Mustang Mach-E and General Motors with the Chevy Bolt are also making significant strides in electrification. These traditional automakers bring decades of experience and resources to compete with newcomers like Rivian.

New entrants like Lucid Motors and NIO disrupt the EV space with advanced technology and luxurious offerings. Each competitor brings unique strengths that challenge Rivian to stay ahead of the curve in innovation, performance, and market penetration.

As the electric vehicle landscape becomes increasingly crowded, Rivian must navigate these competitive waters strategically to solidify its position as a critical player in this dynamic industry.

Expert Predictions on Rivian’s Future

As Rivian continues to disrupt the automotive industry with its innovative electric vehicles, experts are closely monitoring its trajectory for the future. Industry analysts predict that Rivian’s focus on sustainability and cutting-edge technology will position it as a frontrunner in the EV market.

Experts foresee Rivian expanding its product line and global reach, catering to an increasingly eco-conscious consumer seeking high-performance electric vehicles. With strategic partnerships like the one with Amazon for delivery vans, Rivian is poised to make a significant impact beyond personal transportation.

Furthermore, as governments worldwide push for stricter emission regulations, Rivian’s commitment to sustainable mobility aligns perfectly with evolving environmental policies. This could increase demand for their products and services in the coming years.

Experts remain optimistic about Rivian’s prospects in shaping the landscape of electric vehicles and sustainable transportation solutions globally.

Key Factors that Could Impact Rivian’s Stock Price

As an investor eyeing Rivian’s stock, it’s crucial to consider the key factors that could influence its price trajectory. One significant factor is Rivian’s production capacity and delivery numbers. Meeting or exceeding targets can boost investor confidence and increase stock prices.

Another essential aspect to watch is consumer demand for electric vehicles. Any shifts in market preferences towards sustainable transportation options could significantly impact Rivian’s sales figures and, subsequently, its stock performance.

Regulatory developments also play a vital role in shaping the future of EV companies like Rivian. Changes in government incentives, emissions standards, or policies related to clean energy can directly affect the company’s bottom line and market position.

Additionally, monitor competitor actions and innovations within the electric vehicle industry. A breakthrough technology or strategic move from a rival company could pose challenges for Rivian and affect its stock price accordingly.

Global economic conditions and geopolitical events can create uncertainties that may impact Rivian’s stock performance. Staying informed about these external factors is essential for making well-informed investment decisions in this dynamic market environment.

Risks and Considerations for Investing in Rivian

Investing in Rivian comes with its fair share of risks and considerations that potential investors should know. One critical risk is the competitive landscape within the electric vehicle industry, as other established companies are also vying for market share. This could impact Rivian’s growth trajectory and market positioning.

Another consideration is the dependency on government regulations and incentives to promote sustainable transportation. Changes in policies or subsidies could affect demand for electric vehicles, including those produced by Rivian. Additionally, fluctuations in raw material prices, supply chain disruptions, or manufacturing challenges could impact production costs and profitability.

Furthermore, as a relatively young company compared to competitors like Tesla or Ford, Rivian may need help with brand recognition and customer trust. Investors should also monitor macroeconomic factors such as interest rates or geopolitical events that could influence overall market sentiment and investor confidence in the EV sector.

Conclusion: Is Now the Right Time to Invest in Rivian?

With Rivian’s promising growth, strong financial position, and the increasing demand for electric vehicles, many investors see potential in the company. However, it’s crucial to consider the competitive landscape and risks associated with investing in a relatively new player in the market.

Before making any investment decisions, conducting thorough research and consulting with financial advisors to assess whether now is the right time to invest in Rivian is advisable. Monitor market trends, industry developments, and Rivian’s performance indicators to make informed choices about your investment strategy.

As always with investments, taking a cautious approach and considering all factors can help mitigate risks and maximize potential returns. Stay informed and proactive – you stay ahead of the curve when investing in companies like Rivian.