A Lesson in Secure Payments

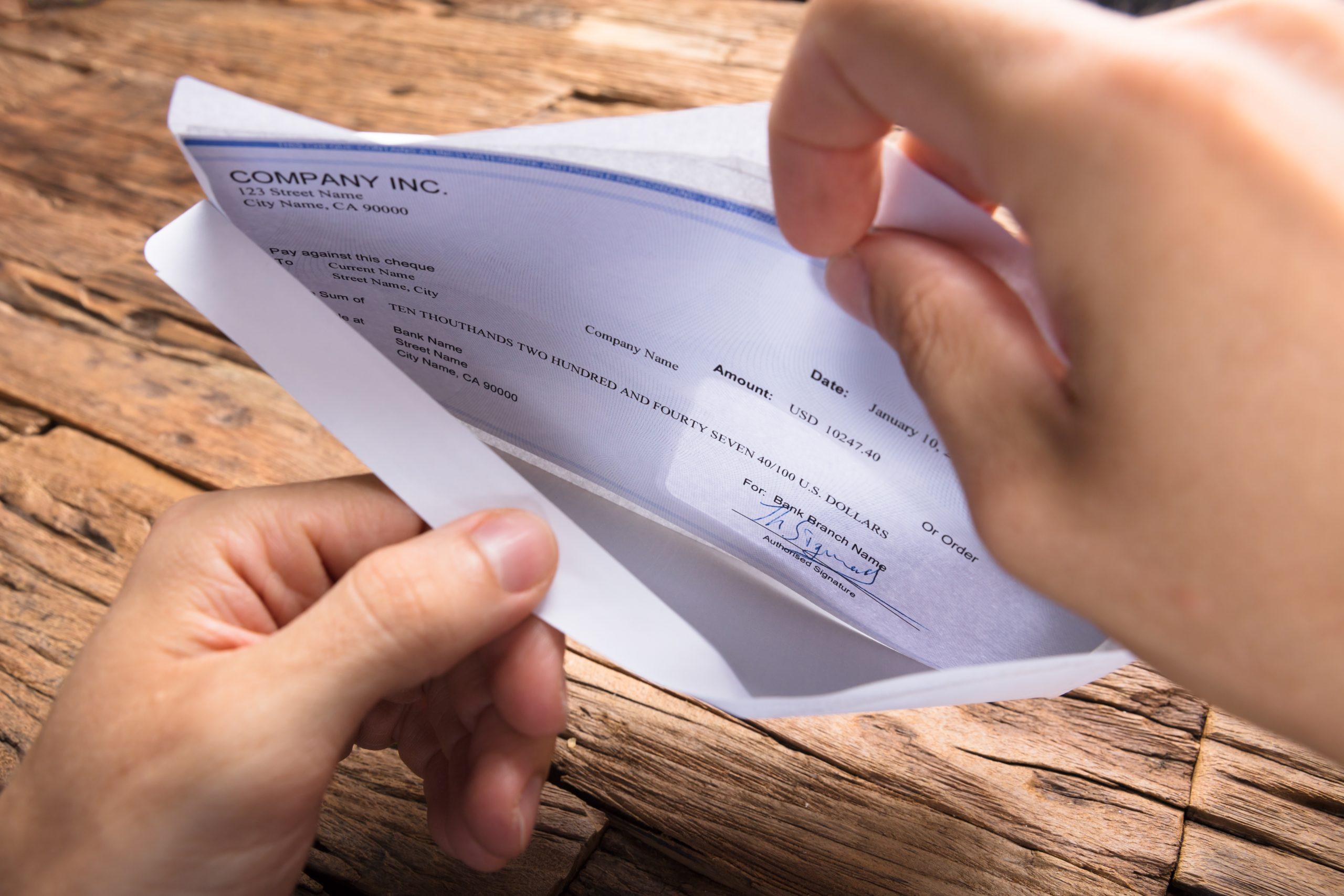

Susan was overjoyed when she received the call that her dream home offer had been accepted. However, one final step before closing the deal was to make the down payment. Her real estate agent advised her to use a cashier’s check to ensure a secure and guaranteed payment. Susan had heard of the cashier’s checks but wasn’t entirely sure where to get them or what the process entailed. As she navigated her options, she realized that finding the right place to obtain a cashier’s check was as important as the check itself. Her experience highlights a common scenario: knowing where to get a cashier’s check is crucial for those significant transactions where security and reliability are essential.

Whether buying a home like Susan, purchasing a car, or making another significant payment, understanding where to get a cashier’s check is essential. This article will explore the different places you can obtain a cashier’s check, the steps involved, the fees you can expect, and important considerations to ensure your transaction goes smoothly.

What is a Cashier’s Check?

A cashier’s check is a payment guaranteed by the issuing bank or credit union. Unlike personal checks, which draw funds directly from your account, a cashier’s check is drawn from the bank’s funds. This makes it a secure payment method, as the bank guarantees the amount, reducing the risk of the check bouncing. Because of its security, cashier’s checks are often used for large transactions, such as real estate purchases, car sales, or paying off significant debts.

Where to Get a Cashier’s Check

Cashier’s checks can be obtained from various financial institutions and services, each offering different advantages. Here’s a breakdown of where you can get a cashier’s check:

- Your Bank or Credit Union

The most common place to get a cashier’s check is from your bank or credit union. If you have an account with a financial institution, you can quickly request a cashier’s check in person, online, or through a mobile app (depending on the bank). The funds for the check will be withdrawn directly from your account, ensuring the check is backed by the bank’s guarantee.

Process: To obtain a cashier’s check, you must provide the amount, payee information, and possibly your I.D….. The bank will withdraw the funds from your account and issue the check. Most banks and credit unions require you to visit a branch to get a cashier’s check, though some offer online or mobile options for existing customers.

Fees: Typically, banks charge a fee for cashier’s checks, ranging from $5 to $15. However, some banks waive the fee for premium account holders or those with certain account types.

Statistic: According to a 2023 Bankrate survey, the average fee for a cashier’s check at significant banks is $10. However, costs can vary widely depending on the institution.

- Online Banks

Many online-only banks also offer cashier’s checks, though the process may differ slightly from that of traditional banks. Since online banks don’t have physical branches, they usually mail the cashier’s check to you or the recipient. This can be convenient if you don’t live near a branch or need the check sent to a third party.

Process: Request a cashier’s check through the bank’s website or mobile app. The bank will withdraw the funds from your account and mail the check to your specified address. This process may take several days, so plan accordingly if you need the check by a certain date.

Fees: Online banks typically charge similar fees for cashier’s checks as brick-and-mortar banks, but some may offer lower fees or waive them for specific accounts.

Pro Tip: If time is a factor, check with the online bank about expedited shipping options for the cashier’s check.

- Credit Unions

Credit unions and member-owned financial institutions are reliable places to get a cashier’s check. They generally offer lower fees and more personalized service compared to traditional banks. If you’re a credit union member, obtaining a cashier’s check is straightforward and often less expensive.

Process: Similar to banks, you’ll need to visit a branch, provide the necessary details, and have the funds available in your account. Some credit unions also offer cashier’s checks through their online banking platforms.

Fees: Credit unions typically charge lower fees than traditional banks, and many offer cashier’s checks for free or at a reduced cost to members.

Statistic: A study by the National Credit Union Administration (NCUA) found that credit unions charge an average of $6 for cashier’s checks, making them a cost-effective option for many consumers.

- Retailers and Check-Cashing Services

Some large retailers, such as Walmart, offer money orders similar to cashier’s checks but not the same. While you can’t get an authentic cashier’s check from these retailers, they may provide money orders as an alternative. However, it’s important to note that money orders usually have lower limits (typically $1,000) and may not be accepted in place of a cashier’s check for large transactions.

Process: Visit a participating retailer or check-cashing service and purchase a money order. While convenient, money orders are less secure than cashier’s checks and may not be accepted for all transactions.

Fees: Money orders typically cost between $1 and $5, depending on the amount and location. However, they may not offer the same security as a cashier’s check, making them less suitable for large payments.

Pro Tip: Use money orders only for smaller payments or when a cashier’s check is not required.

When to Use a Cashier’s Check

Knowing when to use a cashier’s check is as important as knowing where to get one. Cashier’s checks are ideal for large transactions where security is a priority. Everyday situations that may require a cashier’s check include:

- Real Estate Transactions: Cashier’s checks are often used for down payments, closing costs, and other large payments in real estate deals.

- Car Purchases: Whether buying a car from a dealership or a private seller, a cashier’s check assures the funds are secure.

- Loan Payoffs: When paying off a significant loan, such as a mortgage or student loan, a cashier’s check ensures the payment is processed without delay.

- Legal Settlements: Cashier’s checks are frequently used in legal settlements where large sums of money must be exchanged securely.

Statistic: According to the Federal Reserve, cashier’s checks are among the most trusted forms of payment for large transactions, with a fraud rate significantly lower than personal checks or money orders.

The Process of Obtaining a Cashier’s Check

Getting a cashier’s check is straightforward, but knowing what to expect is essential. Here’s a step-by-step guide to help you through the process:

- Confirm the Amount and Payee: Double-check the amount and spelling of the payee’s name, as mistakes cannot be easily corrected once the check is issued.

- Visit Your Bank, Credit Union, or Online Platform: Depending on your choice, visit the financial institution in person or request the check online.

- Provide Necessary Information: You must provide the payee’s name, the exact amount, and identification.

- Pay the Fee: You will be charged a fee for the cashier’s check unless it is waived due to your account type or membership status.

- Receive the Check: Once the transaction is complete, you’ll receive the cashier’s check, which is ready to be delivered to the payee.

Pro Tip: Always keep a receipt or a record of the cashier’s check number in case it’s lost or stolen. Most banks can issue a replacement, but the process may take time.

Conclusion: Choosing the Right Place for Your Cashier’s Check

A cashier’s check is a vital tool for secure, large transactions. Whether buying a home, paying off a loan, or making another significant payment, knowing where to get a cashier’s check can save you time, money, and stress. By understanding your options—whether at a bank, credit union, or online—you can choose the method that best fits your needs and ensures your transaction goes smoothly.

Just like Susan, who found peace of mind by securing her down payment with a cashier’s check, you, too, can confidently navigate the process. By selecting the right place to get your cashier’s check, you can ensure that your payment is secure, your transaction is booming, and your financial needs are met.

F.A.Q. Section

Q: Can I get a cashier’s check without a bank account?

A: You need a bank or credit union account to obtain a cashier’s check. However, some check-cashing services may offer alternatives like money orders, which are not the same as cashier’s checks.

Q: How long does it take to get a cashier’s check?

A: If obtained in person, you can usually get a cashier’s check immediately. Online requests may take several days to process and mail.

Q: Are there any risks associated with cashier’s checks?

A: While cashier’s checks are secure, caution is essential when dealing with scams. Always verify the authenticity of a cashier’s check before accepting it as payment.

Q: Can I cancel a cashier’s check after it’s issued?

A: Canceling a cashier’s check is difficult and often requires a stop payment order, which can take time and may involve a fee. Always ensure the check is correct before issuance.

Q: What should I do if I lose a cashier’s check?

A: Contact the issuing bank immediately. They may be able to issue a replacement, though there may be a waiting period to ensure the original check isn’t cashed.