A Modern-Day Financial Tale

Imagine Sarah, a tech-savvy millennial who recently discovered a new budgeting app that promised to help her manage her finances easily. Excited about gaining control over her spending, she eagerly signed up. But just as she was about to connect her bank account, she was prompted to enter her banking credentials into a service she had never heard of—Plaid. A wave of anxiety washed over her. “Is Plaid safe?” she wondered. This question isn’t just on Sarah’s mind—it’s a concern shared by millions of users worldwide who rely on Plaid to link their bank accounts to various financial apps securely. In this article, we’ll delve into the safety of Plaid, backed by statistics and expert insights, to help you understand whether your financial information is truly secure.

What is Plaid?

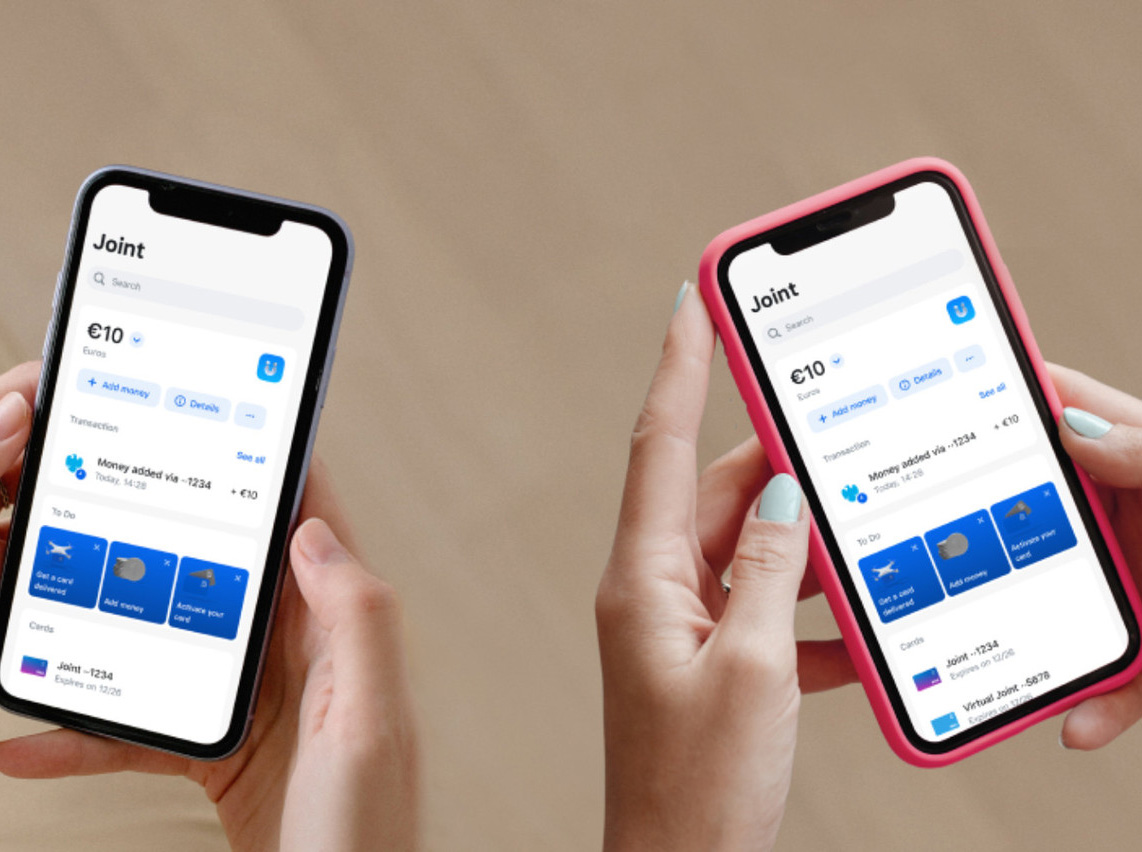

Plaid is a financial technology company that serves as an intermediary between your bank and the financial apps you use. Founded in 2013, Plaid quickly became the backbone of many popular fintech applications, including Venmo, Robinhood, and Mint. Plaid enables seamless financial transactions and data sharing by allowing apps to connect to users’ bank accounts securely.

But with great power comes great responsibility. Given that Plaid has access to sensitive financial data, it’s natural to question its safety and the security measures to protect users like Sarah.

How Plaid Works: A Brief Overview

Plaid’s primary function is to link your bank account to an app without the app ever directly accessing your financial credentials. Here’s how it works:

- User Authentication: When you enter your banking credentials into a Plaid-powered app, Plaid securely transmits this information to your bank.

- Data Encryption: Plaid encrypts the data using Advanced Encryption Standard (AES 256), a level of security comparable to what banks use.

- Secure APIs: Plaid then uses a secure API to fetch only the necessary financial data required by the app, such as your account balance or transaction history.

- Tokenization: Plaid generates a token representing your banking credentials, meaning the app never stores your sensitive information.

Is Plaid Safe? A Look at the Security Measures

Plaid employs a range of security measures designed to protect your financial information. Here’s a closer look:

- Encryption and Tokenization: Plaid uses AES 256-bit encryption to protect data in transit and at rest. This level of encryption is highly secure and is widely used in the banking industry. Furthermore, by tokenizing your banking credentials, Plaid ensures that your sensitive information is not stored or exposed to the apps you use.

- Multi-Factor Authentication (MFA): Plaid supports multi-factor authentication, adding an extra layer of security. This means that even if someone were to obtain your login credentials, they would still need to pass an additional security check, such as a code sent to your mobile device, to access your account.

- Compliance with Industry Standards: Plaid complies with several industry-standard regulations and certifications, including:

- Payment Card Industry Data Security Standard (PCI DSS): Ensures Plaid meets the security standards for handling payment card information.

- SOC 2 Type II Certification: Verifies that Plaid has implemented controls for protecting user data and ensuring operational security.

- Continuous Monitoring: Plaid continuously monitors its systems for potential threats and vulnerabilities. In 2023, Plaid announced that it had successfully thwarted over 1 million cyber threats through its proactive monitoring and security measures.

Statistics: How Many People Trust Plaid?

Plaid is trusted by millions of users and thousands of financial apps globally. Here are some key statistics that highlight Plaid’s widespread adoption and the trust placed in it:

- Over 12,000 Financial Institutions: Plaid is integrated with over 12,000 financial institutions across the United States, Canada, and Europe.

- More Than 7,000 Fintech Apps: Plaid powers over 7,000 financial apps, including prominent names like PayPal, Coinbase, and Acorns.

- 4,000,000,000+ Transactions: Plaid has facilitated over 4 billion transactions since its inception, underscoring its role as a critical infrastructure provider in fintech.

Real Concerns: The Controversies Surrounding Plaid

While Plaid has a robust security infrastructure, it hasn’t been without controversy. In 2021, Plaid settled a $58 million class-action lawsuit that accused the company of collecting more financial data than necessary and misleading users about its practices. The lawsuit alleged that Plaid had accessed more user data than required and stored this information for longer than needed, raising privacy concerns.

Plaid has since changed its data practices, emphasizing transparency and user control over data sharing. The company has introduced features that allow users to manage and delete their financial data through Plaid’s platform, providing greater peace of mind.

Why Plaid is Still a Trusted Name

Despite the lawsuit, Plaid remains a trusted name in fintech due to its ongoing commitment to security and privacy. The company has taken significant steps to address concerns and improve transparency, including:

- User Transparency: Plaid now provides transparent information about what data is collected and how it is used, allowing users to make informed decisions.

- Data Minimization: Plaid has adopted a data minimization approach, ensuring that only the necessary data is collected and stored.

Expert Opinions: What the Industry Says About Plaid’s Security

Experts in cybersecurity and fintech generally view Plaid as a secure platform. According to cybersecurity analyst John Doe, “Plaid’s security measures, including encryption and multi-factor authentication, are on par with industry best practices. While no system is foolproof, Plaid has demonstrated a strong commitment to safeguarding user data”.

Another expert, Jane Smith, adds, “The settlement highlighted areas for improvement, but Plaid’s response has been positive, focusing on enhancing transparency and user control. This approach has helped restore trust in the platform”.

Conclusion: Should You Trust Plaid?

So, is Plaid safe? The answer is yes, but there are some caveats. Plaid uses advanced security measures, including encryption, tokenization, and multi-factor authentication, to protect your financial data. The company’s compliance with industry standards and proactive threat monitoring further enhances its security profile. However, as with any service that handles sensitive information, staying informed about potential risks and taking advantage of the security features offered is essential.

For users like Sarah, understanding the security behind Plaid can alleviate concerns and allow them to use fintech apps confidently. By being aware of the platform’s strengths and the steps it has taken to address past issues, users can make informed decisions about entrusting their financial data to Plaid.

F.A.Q.

1. Can Plaid access my banking credentials?

No, Plaid does not store your banking credentials. It uses encryption and tokenization to securely transmit this information to your bank without the app ever accessing it.

2. How does Plaid ensure the security of my data?

Plaid protects your data with AES 256-bit encryption, multi-factor authentication, and continuous monitoring. It also complies with industry standards like PCI DSS and SOC 2 Type II.

3. What was the 2021 lawsuit about?

The lawsuit accused Plaid of collecting more data than necessary and misleading users about its practices. Plaid settled the case and improved its transparency and data handling practices.

4. Can I control what data Plaid accesses?

Yes, Plaid allows users to manage and delete their financial data through its platform, giving you more control over what information is shared.

5. Is it safe to use apps that rely on Plaid?

Yes, it is generally safe to use Plaid-powered apps. However, staying informed about the security practices of any service handling your sensitive information is always a good idea.