Managing payroll is one of the most important and time-consuming tasks for any entrepreneur. For many owners, switching to direct deposit for small business has become a game-changer. Not only does it streamline payment processing, but it also boosts employee satisfaction and reduces paperwork. Whether you’re paying one person or a growing team, direct deposit offers convenience, accuracy, and professionalism.

This guide walks you through everything you need to know—from how direct deposit works to how to set it up, its benefits, compliance requirements, and top provider options. If you’re a small business owner looking for a smarter payroll method, this article will show you why direct deposit should be your go-to solution.

What Is Direct Deposit?

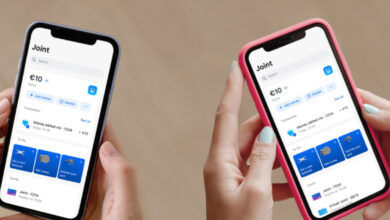

Direct deposit is an electronic payment method that transfers funds directly from your business bank account into your employee’s checking or savings account. It eliminates the need for paper checks, allowing employees to receive their wages safely and quickly, often on the same day each pay cycle.

How It Works

- You initiate payroll through your direct deposit system or payroll software.

- The payment is authorized through the Automated Clearing House (ACH) network.

- Employees receive their funds automatically in their bank account.

Why Choose Direct Deposit for Small Business?

Efficiency and Time-Saving

Manually writing and delivering checks takes time. Direct deposit automates the entire payroll process, saving hours of admin work every month.

Cost-Effective

Direct deposit reduces costs associated with:

- Printing checks

- Paper supplies

- Postage

- Bank processing fees for check deposits

Reliability and Accuracy

Electronic payments are more accurate than handwritten checks. You reduce the chances of lost checks, delayed delivery, or manual errors.

Professional Image

Using direct deposit gives your business a polished and trustworthy appearance—especially valuable when hiring or working with contractors.

Key Benefits of Direct Deposit

1. Faster Payroll Processing

You can schedule payroll in advance, automate regular payments, and complete the process in just a few clicks.

2. Improved Recordkeeping

Most direct deposit systems automatically generate digital records for each transaction. This simplifies accounting, auditing, and end-of-year tax filings.

3. Employee Convenience

Employees no longer need to visit the bank or cash a physical check. Payments are deposited directly and consistently into their accounts.

4. Better Security

Eliminates the risks of check fraud, theft, or misplacement. Electronic transfers are encrypted and far more secure.

5. Supports Remote Teams

If you have remote or hybrid employees, direct deposit ensures everyone is paid on time, no matter where they’re located.

How to Set Up Direct Deposit for a Small Business

Step 1: Open a Business Bank Account

You’ll need a business checking account to process payroll payments legally and efficiently.

Step 2: Choose a Payroll or Direct Deposit Provider

You can use:

- Payroll software with built-in direct deposit (e.g., Gusto, QuickBooks, ADP)

- A standalone bank or ACH provider

Step 3: Collect Employee Information

Request employees to fill out a direct deposit authorization form that includes:

- Bank name and address

- Routing number

- Account number

- Account type (checking or savings)

Step 4: Enter and Verify Information

Input data into your payroll system. Run a test transaction or pre-note transfer to verify account accuracy before launching full payroll.

Step 5: Process Payroll

Once verified, schedule and process payroll payments based on your pay frequency (weekly, bi-weekly, monthly).

Compliance and Legal Considerations

Federal and State Laws

While federal law permits employers to require direct deposit, some states have specific rules regarding consent, pay stub requirements, and employee rights. Always check your local labor laws.

Record Retention

Maintain payroll and direct deposit records for at least three years (or longer based on state requirements) to remain compliant with tax and labor regulations.

Secure Handling of Data

Ensure that employee bank details are stored securely, encrypted, and accessible only to authorized personnel.

Choosing the Best Direct Deposit Provider for Small Business

Key Features to Look For

- Low or no monthly fees

- Integration with accounting software

- Tax filing capabilities

- Automatic reminders and reports

- Mobile access

- Reliable customer support

Popular Providers

- Gusto – Best for small teams and full-service payroll

- QuickBooks Payroll – Great for businesses using QuickBooks

- ADP – Scalable solution for growing businesses

- Paychex – Feature-rich with HR support

- Square Payroll – Ideal for hourly and contract-based teams

Frequently Asked Questions

How much does direct deposit cost for small businesses?

Fees vary by provider. Some banks offer free direct deposit, while payroll services may charge $1–$3 per employee per month or include it in a monthly plan.

Is direct deposit safe for small businesses?

Yes, it is encrypted and regulated by the ACH (Automated Clearing House) network. Following basic data security practices will keep it safe and secure.

How long does it take to set up?

Setup usually takes 1 to 5 business days, including verification. Once live, transfers generally complete in 1–2 business days per pay cycle.

Can I use direct deposit for contractors or freelancers?

Yes. Direct deposit is a convenient way to pay contractors. Just ensure you classify them properly and report payments on the appropriate IRS forms.

Pros and Cons of Using Direct Deposit

| Pros | Cons |

|---|---|

| Faster and more efficient | May have setup or monthly fees |

| Improved employee satisfaction | Requires internet and system access |

| Reduced risk of errors and fraud | Dependent on accurate information |

| Easier payroll recordkeeping | Delays if banking info is incorrect |

Conclusion

For small business owners looking to simplify payroll, reduce manual errors, and improve employee satisfaction, direct deposit for small business is a practical, scalable, and secure solution. It saves time, reduces costs, and provides a better overall experience for everyone involved.

If you’re still using checks or cash, now is the time to consider making the switch to direct deposit. Your future self—and your employees—will thank you.